Allgemein formuliert sind Bitcoin-Futures Handelsverträge zwischen zwei Parteien bei dem die Währung zu einem festen Preis und zu einem bestimmten Zeitpunkt in der Zukunft gekauft oder verkauft werden kann. Bitcoin futures are futures contracts that speculate on the price of Bitcoin without participants actually having to own Bitcoin.

Bitcoin Futures Best Exchanges And How Trading Works Review Master The Crypto

Bitcoin Futures Best Exchanges And How Trading Works Review Master The Crypto

Bitcoin CFD Trading Summary.

Bitcoin futures contract. Bitcoin CFDs Contracts for Difference and futures are investment vehicles that allow you to speculate on the price of Bitcoin without actually buying the coins. In the case of bitcoin futures the underlying asset is bitcoin. In brief A futures contract is an agreement that obligates a trader to buy or sell an asset at a specific time quantity and.

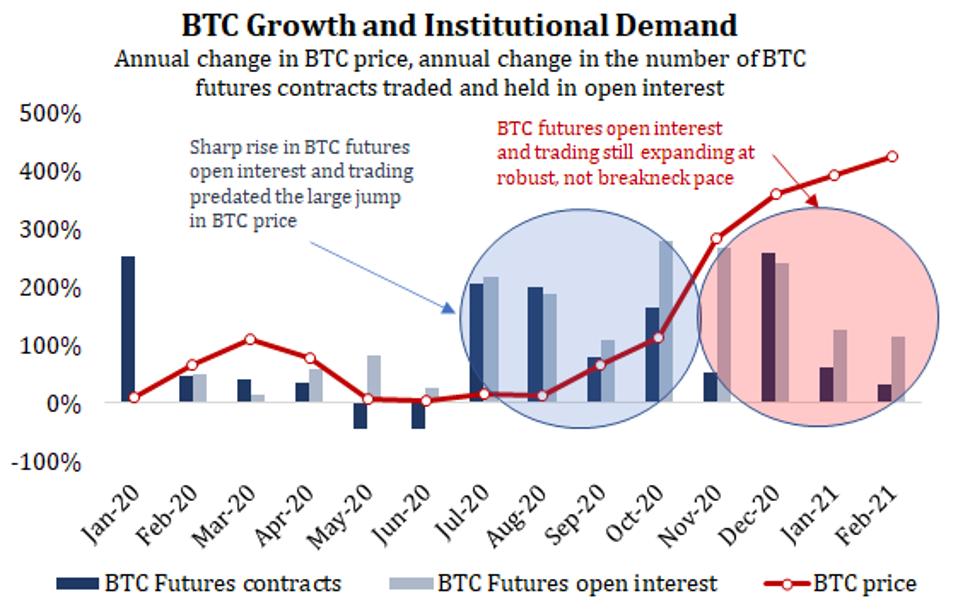

6 Zeilen One Bitcoin futures contract each futures contract equals 5 bitcoin Minimum Price. Bitcoin futures help to bring in additional liquidity to the market and also provide opportunities for arbitrage. This means that based on current prices of 18000-ish you would need to fork out 90000 per contract.

This can have a few benefits. However there are also so-called perpetual contracts ie. Overnight Globex prices are shown on the page through to 7pm CST after which time it will list only trading activity for the next day.

A futures contract is a financial product that derives its value from an underlying asset. However futures contracts offer ways for investors to make money off of movements in Bitcoins price without having to ever hold any Bitcoin directly. Upcoming futures trading platforms like Bakkt offer physical delivery of the underlying asset for contracts but it still remains within their custody rather than the purchasing party having to directly buy and sell Bitcoin on cryptocurrency exchanges.

At 110 the size of one bitcoin Micro. If an investor speculates that the price of Bitcoin will rise in future heshe enters into a futures contract to buy Bitcoin at a certain predetermined price with a Bitcoin seller. Sunday-Friday 6 pm-5 pm.

Below are the contract details for Bitcoin futures offered by CME. 5 Zeilen Tap into the precision of a smaller-sized contract. Bitcoin futures enable traders to get exposure to digital assets like Bitcoin without having to physically or digitally in this instance hold the underlying assetBitcoin Futures operate like a standard futures contract for a stock commodity bond or index and allow Bitcoin futures traders to speculate on the future price of Bitcoin.

Futures contracts without an expiry date. These contracts are basically used to buy or sell bitcoin in the future at a fixed price in the present and therefore have a specific expiration date at which the settlement occurs. 5 Bitcoin as defined by the CME CF Bitcoin Reference Rate Price quotation.

It represents a legal agreement to buy or sell the underlying on a specified future date at an already agreed price. One is that Bitcoin trading is currently unregulated or poorly regulated in many markets but futures trading has much clearer rules surrounding it. The All Futures page lists all open contracts for the commodity youve selected.

The value of a Bitcoin futures contract is usually determined in BTC. Many bitcoin futures contracts have an expiration date. BTCV2021 D BITCOIN FUTURES OCT 2021 2021-11-01.

Many market participants who cannot hold spot positions in bitcoin cryptocurrency due. For example if you had access to the institutional Bitcoin futures market offered by CME each contract is worth 5 BTC. Contracts listed for 6 consecutive months and 2 additional.

This post will explain what Bitcoin CFDs are and how they are different from Bitcoin futures. Contract Type Symbol Price Premium Volume Open Interest last index nom a USD USD Perpetual. Bitcoin futures is a futures contract where the involved asset is Bitcoin.

However the Micro Bitcoins smaller contract size. Bitcoin futures contracts were launched in December of 2017 and have already gained traction in the market. CMEs existing Bitcoin futures represent five Bitcoins per contract which at current Bitcoin prices represent a substantial upfront cost.

Intraday futures prices are delayed 10 minutes per exchange rules and are listed in CST.