With Vonage Toll-Free Numbers customers simply purchase a toll-free number and select a volume minute bundle. Great for remote teamsand any business that doesnt need desk phones.

Vonage Business Communications Phone Plans Prices Vonage

Vonage Business Communications Phone Plans Prices Vonage

799 per month plus taxes and fees.

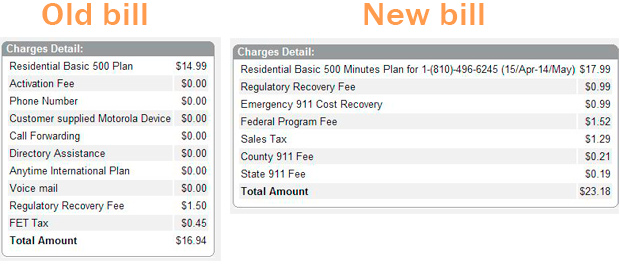

Vonage price taxes. 10399 per month plus taxes and fees. Taxes and fees can be assessed on the following as applicable and are subject to change. Vonage is obligated to collect taxes and fees per state and federal regulations.

VONAGE PRICETAXE 866-243-4357 NJ charge has been reported as unauthorized by 68 users 14 users recognized the charge as safe. Pos purch vonage pricetaxes 866-243-4357 nj. Tax Manager 23 Main Street Holmdel NJ.

The charge VONAGE PRICETAXE 866-243-4357 NJ was first reported Jan 7 2014. If you have Vonage as a carrier it is a normal charge. Pre-auth vonage pricetaxes 866-243-4357 nj.

Discount of 1000 applied each month for first 6 months and then standard rates for this plan will apply which are subject to change. Price guarantee applies to base monthly rate only and excludes fees taxes additional or premium services and other charges. Communicate and collaborate on any device including your desk phones.

Click on your state in the table below to view the taxes and fees specific to that state. See plans and pricing. 299 per month plus taxes and fees.

There are 4369 searches per month from people that come from terms like vonage price taxes or similar. Emergency 911 and Information Services Fee The Emergency 911 and Information Services Fee is a Vonage fee not a government mandated fee. State Sales Tax 40 plus any county or city sales tax 0 to 45 Additional 375 sales tax applies within Metropolitan Commuter Transportation District MCTD.

It comes from Denmark. SPECIAL ONLINE ONLY OFFERS. Limited-time offer for new Vonage customers with 1-yr agreement.

Pricing starts as low as 1999 plus taxes and fees. Early termination may be subject to fees. For the 1st 6 mos then 2999mo with 1-year agreement.

Vonage World calling plan offers unlimited international calling to 60 countries for only 1999mo. 1 PLUS try Vonage Business Communications free for 14 days if you buy online up to 99 lines. Main local company number included for online purchases.

Vonage Business Communications makes it easy for businesses to set up toll-free lines. 2999monthline plus taxes fees. 2599 per month plus taxes and fees.

Pos debit vonage pricetaxes 866-243-4357 nj. Cloud-based business phone systems. This is your phone bill from Vonage including taxes it is based in New jersey.

Vonage pricetaxe 866-243-4357 nj VONAGE PRICE TAXES 866-243-4357 2021 Whats That Charge - About Us - Nyckel machine learning API - Personal Finance Club All Rights Reserved. Upgrade your office communications to a single flexible platform that offers. 1999monthline plus taxes fees.

Tax exemption will only apply from the date we receive your certificate. Pos pur vonage pricetaxes 866-243-4357 nj. Vonage toll-free bundles are highly flexible - allowing you to adjust your bundle as inbound usage increases or decreases.

28999 per month plus taxes and fees. Valid credit debit card or checking account only. Taxes and fees can be assessed on the following as applicable and are subject to change.

Early Termination Fee Vonage offers a few select calling plans that come with an early termination fee. Click on your state in the table below to view the taxes and fees specific to that state. 19999 per month plus taxes and fees.

Pos refund vonage pricetaxes 866-243-4357 nj. Taxes fees are extra. Vonage pricetaxe 866-243-4357 nj What is it.

Make and receive calls on your home phone and. Help other potential victims by sharing any available information about VONAGE PRICETAXE 866-243-4357 NJ. Pending vonage pricetaxes 866-243-4357 nj.

Vonage is obligated to collect taxes and fees per state and federal regulations. VONAGE-PRICE-TAXE-866-243-4357-NJ has been in the DB for a while it is the number 29626. ETF of 120 but Vonage.

If you are exempt from payment of any of these taxes you must provide us with an original certificate that satisfies the legal requirements attesting to tax-exempt status by sending the certificate to Vonage America LLC Attn. New Mexico Taxes and Fees Taxes and fees are subject to change. Unlimited calls and Call Recording.

Pos purchase vonage pricetaxes 866-243-4357 nj. Visa check card vonage pricetaxes. 3999monthline plus taxes fees.

Upgrade your office communications to a single flexible platform that offers. Find Vonage Terms of Service e911 acknowledgements privacy policy and more here. Communicate through your mobile device and desktop.

Mobile and desktop apps. Vonage Business Communications Looking to transform your employee and customer experiences. 95099 per month plus taxes and fees.