Transfer money online in seconds with PayPal money transfer. Select your loan amount.

Paypal Working Capital Updated For 2020 Get Funded Today And Learn More About Paypal Working Capital Loan Builder

Paypal Working Capital Updated For 2020 Get Funded Today And Learn More About Paypal Working Capital Loan Builder

There are no periodic interest charges monthly bills late fees pre-payment fees penalty fees or any other fees.

Paypal working capital wait 3 days. You repay the loan and fee with a percentage of your PayPal sales minimum payment required every 90 days. With PayPal Working Capital you can only have one open loan at a time. The maximum loan amount depends on your PayPal.

Your final payment on any loan may take up to three days to process so keep that in mind when youre planning additional loans. This means receipts into a PayPal account are not always reliable. For the first 18 months of the loan you will need to have paid aÄhnliche Suchvorgänge für paypal working capital wait 3 days3 day wait gun law3 day wait on gunsclosing disclosure 3 day waitflorida 3 day wait3 day wait periodtrid 3 day waitflorida 3 day wait exemptionEinige Ergebnisse wurden entferntPaginierung12345WeiterMehr anzeigenBetriebsnotwendiges VermögenBetriebsnotwendiges Vermögen Net Operating Assets ist eine betriebswirtschaftliche Kennzahl die das zur Erreichung des Betriebszweckes erforderliche Vermögen oder Kapital eines Unternehmens wiedergibt.

PayPal Working Capital PPWC loans work like traditional merchant cash advances in many ways. If you have a premier account you must process 12000 of yearly PayPal sales. It always has to be paid in full 30 days before arrival.

Business Formulas Last updated. If they were low you should wait. This gives the system time to process any lagging payments youve made and to finalize your existing agreement.

Click here to apply for PayPal Working Capital or find it in your PayPal account. Always try and work. This is an invitation to apply and not an offer or commitment to provide capital.

There are a few differences to be aware of however. It offers a lump-sum amount paid into your PayPal account that you pay back by giving PayPal a percentage of all future income until the debt is cleared. The program is very similar to a merchant cash advance.

Youll need to supply. The process is easy. This is of course convenient for any small business who makes regular use of PayPal but for thoseAutor.

How do I apply. All you need is an email address. Ive had people that stay several months.

Typical expenses covered by working capital include payroll and rent. PayPal Working Capital is available to PayPal business account holders. If you have a premier account you must process 12000 of yearly PayPal sales.

PayPal Working Capital and Business Loans. It seems the pandemic is affecting approvals. Whats New 3 12 24 72.

These are the day-to-day costs of keeping your business running. These are the day-to-day costs of keeping your business running. Typical expenses covered by working capital include payroll and rent.

1 To apply for PayPal Working Capital your business must have a PayPal business or premier account for at least 90 days and process at least 15000 or for premier accounts 20000 within those 90 days or within any time period less than or equal to 12 months. Paypal Working Capital- pay off then apply for a second. Your final payment on any loan may take up to three days to process so keep that in mind when youre planning additional loans.

September 16 2019 0. My Profile My Preferences My Mates. So I am not doing retail sales but service and the decision.

PayPal Working Capital is a business loan for PayPal sellers that you can apply for in minutes and immediately access through your PayPal account. This is of course convenient for any small business who makes regular use of PayPal but for those. If they are having to pay in full 30 days before arrival and staying several months Than you would hAVE months where alot of money comes in and it is only one or two transactions.

A working capital loan can come in various forms including a short-term working capital55 13KGeschätzte Lesezeit. PayPal sales include processing on PayPal Express Checkout PayPal Payments Standard PayPal Payments Pro and PayPal. To apply for PayPal Working Capital your business must have a PayPal business or premier account for at least 90 days and process between 15000 or for premier accounts 20000 and 20 million within those 90 days or within any time period less than or equal to 12 months.

Always try and workPayPal Working Capital Review For 2021 - SMEDiese Seite übersetzenhttpssmeloanscoukblogpaypal-working-capital-review In order to be accepted for PayPal Working Capital you must have had a PayPal business account for at least 90 days 3 months and process yearly PayPal sales of 9000 at minimum. Paypal working capital wait 3 days. My Profile My Preferences My Mates.

Youll need to supplyGeschätzte Lesezeit. Whats New 3 12 24 72. I hope this helps those who are looking to pay off a loan early with.

PayPal sales include processing on PayPal Express Checkout PayPal Payments Standard PayPal Payments Pro and PayPal Here. There are no periodic interest charges monthly bills late fees pre-payment fees penalty fees or any other fees. The program is very similar to a merchant cash advance.

You repay the loan and fee with a percentage of your PayPal sales minimum payment required every 90 days. It signals to the decision computers that people may not continue to buy your product and this will put you in a position where you may not be able to repay the working capital loan that you took. There are a few differences to be aware of however.

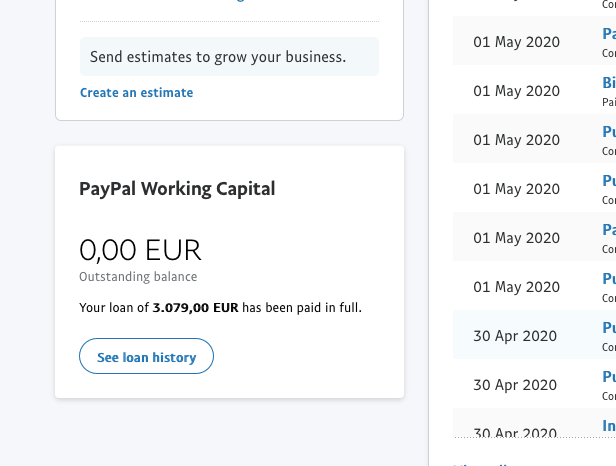

When you pay off one loan you can open another. PayPal Working Capital provides additional working capital to businesses that use PayPal. Select your loan amount.

PayPal Working Capital provides additional working capital to businesses that use PayPal. When you pay off one loan you can open another. I applied for Working Capital today and received a message that said theyd let me know their decision in 7 days.

For the first 18 months of the loan you will need to have paid a. How do I apply. PayPal working capital loans are.

Ive had 6 Working Capital loans over the years and always been approved instantly. Borrowers can receive up to 35 of their annual sales conducted via PayPal with a borrowing limit of 125000 and terms of up to 18 months. Your PayPal returns are too high.

So before paying off a loan with the expectation to re apply please use the paypal insights to see what your last 3 months were. Many businesses even online merchants use PayPal as a secondary payment method. Your PayPal returns are too high.

Than months where no revenue might come in. Wikipedia Benutzer suchen auch nachUmlaufvermögenGeldumschlagFreie Cash FlowsAbschreibungInvestitionsausgabenAcid Test RatioForderungMehrNeuer Inhalt wird bei Auswahl oberhalb des aktuellen Fokusbereichs hinzugefügtDaten von. The debt is paid off via a percentage of daily sales that go towards the borrowers PayPal.

So the new criteria will be August September and October. The system will reupdate according to the rep on the second week in November. Working capital refers to the money needed to cover everyday operating expenses in your business.

A working capital loan gives businesses the cash they need to cover these ongoing everyday operational costs. A working capital loan can come in various forms including a short-term working capital. It signals to the decision computers that people may not continue to buy your product and this will put you in a position where you may not be able to repay the working capital loan that you took.

1 minPayPal Working Capital. PayPal Working Capital is a business loan with one affordable fixed fee. If they are having to pay in full 30 days before arrival and staying several months Than you would hAVE months where alot of money comes in and it is only one or two transactions.

So just like anything else PayPal doesnt want to see that everything you sell gets returned or more realistically that there is a high rate of this happening. This means receipts into a PayPal account are not always reliable. Es ist nicht zu verwechseln mit dem notwendigen Betriebsvermögen.

Click here to apply for PayPal Working Capital or find it in your PayPal account. It offers a lump-sum amount paid into your PayPal account that you pay back by giving PayPal a percentage of all future income until the debt is cleared. Borrowers can receive up to 35 of their annual sales conducted via PayPal with a borrowing limit of 125000 and terms of up to 18 months.

Ive had people that stay several months. There are no credit checks and there is no interest you simply choose how fast you want to pay them back 10 to 30 of future income and then. PayPal Working Capital Second Loan Wait 3 Days Once you have paid off your first loan PayPal advises waiting 3 5 days before applying again for a second loan through their service.

The debt is paid off via a percentage of daily sales that go towards the borrowers PayPal55 Geschätzte Lesezeit. So just like anything else PayPal doesnt want to see that everything you sell gets returned or more realistically that there is a high rate of this happening. Than months where no revenue might come in.

Paypal Working Capital- pay off then apply for a second one. The process is easy. Many businesses even online merchants use PayPal as a secondary payment method.

In order to be accepted for PayPal Working Capital you must have had a PayPal business account for at least 90 days 3 months and process yearly PayPal sales of 9000 at minimum. What Is PayPal Working Capital. A working capital loan gives businesses the cash they need to cover these ongoing everyday operational costs.