Within the past six months you cant have received an increase or decrease in your limit on that account. Dont want to be considered for a credit limit increase.

How To Get A Capital One Credit Line Increase Tips 2020 Uponarriving

How To Get A Capital One Credit Line Increase Tips 2020 Uponarriving

Once the bureaus have had time to update your info you can request a credit limit increase again by visiting Capital One.

Capital one credit limit increase. More specifically for online requests log in to your account from the Capital One credit limit increase page. If youre eligible for an increase we may reach out to you with an offer. Getting a higher credit limit with Capital One requires active credit card use and paying off your balance on time.

If youve received a credit limit increase offer you can accept the increase in the Capital One mobile app in online banking or over the phone through our automated system. Then request a credit line increase and follow the directions to accept your new credit limit if. You can request a credit line increase two different ways with Capital One online or by phone.

They will not grant a CLI if your card has received an increase in the previous 6 months which includes account consolidations. Although theres no fixed time period accounts are typically open for at least 6 months before theyre considered for a credit limit increase. You can get a credit increase with Capital One online or over the phone.

A request starts an approval process from the lender as detailed by the Federal Deposit Insurance Corporation FDIC. Generally the company will review your credit history and consider how much additional credit you asked for. Tips for a Capital One credit limit increase Spend big on your card.

Increasing Your Limit The first way to access more credit is to request an increase. Capital One regularly reviews accounts to determine eligibility for credit limit increases. Oftentimes Capital One will automatically increase your credit limit if you use your credit card responsibly.

Your account must be three months old at least. Capital One will reset your credit limit to its previous amount. In order to qualify for a credit limit increase with Capital One your account needs to meet the following requirements.

If you receive a credit limit increase youd rather not have on your Capital One card just call 1-800-CAPITAL 1-800-227-4825. Message 2 of 22. If not you can inquire about getting an increase yourself over the phone.

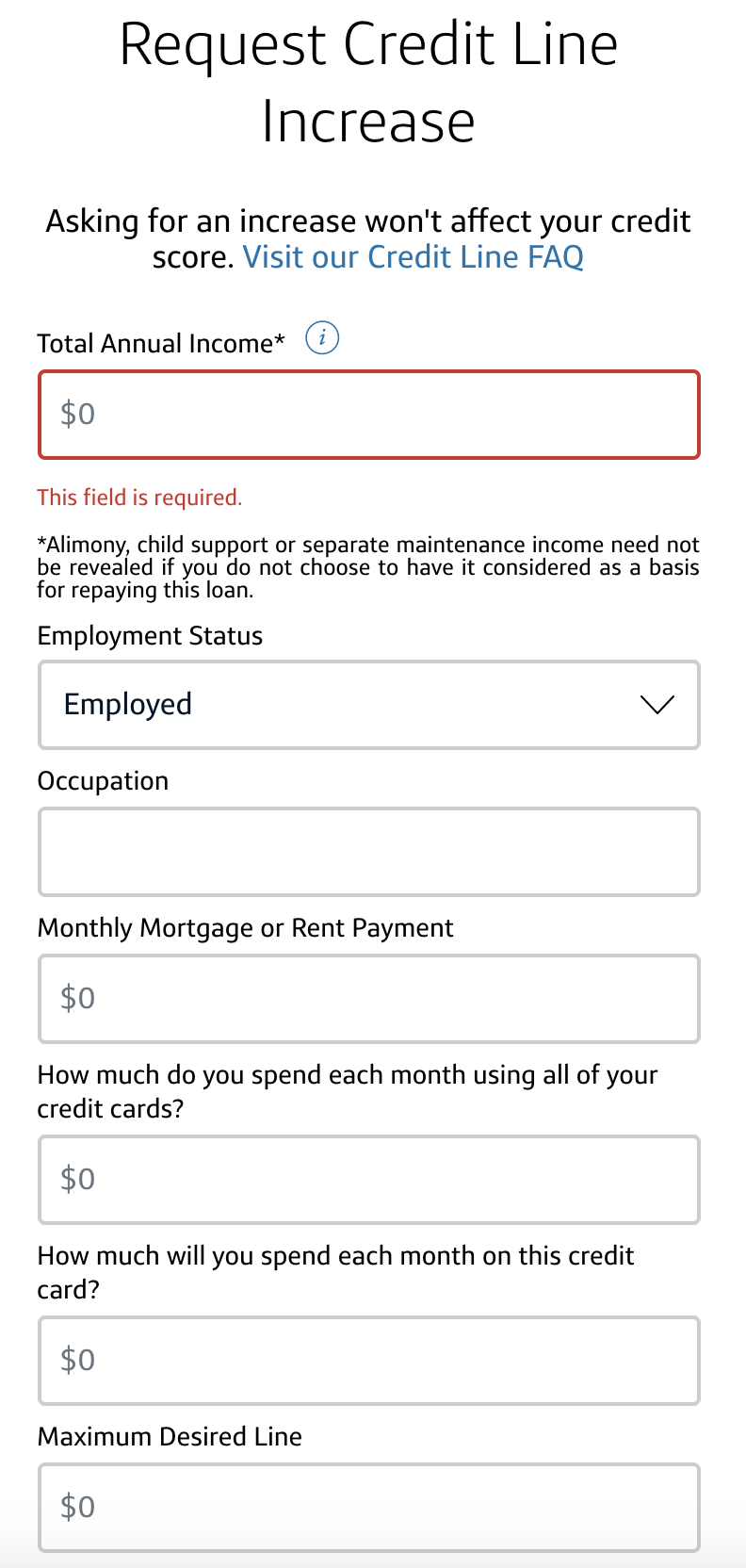

How to request a credit limit increase Youll need to give us some information like your total annual income employment status and monthly mortgage or rent payment so have that handy. Well gladly review your account again to see if youre eligible and try reaching out to you again to verify your identity. Another factor that Capital One is going to look at is how often do you pay off high balance.

You may be subject to a review of your overall credit history before approval and if you have a poor credit history or a large balance left on your current Capital One card your request may be denied. You cant have received an increase or. If you manage your credit well Capital One may increase your credit line on its own.

Merge your credit. Now there are some things that are required to receive a credit limit increase with Capital One. Call the same number to opt out of consideration for the next five years.

This is especially true with the issuers credit building and student credit cards which advertise the opportunity for a higher credit line after five months of on-time payments. Also obviously your account must be unsecured. The only exceptions are if your credit card account is less than three months old or you have had a credit line increase within the last six months.

To be eligible for a Capital One credit-line increase you must have an unsecured credit card your account must be at least 3 months old and you cant have had a credit increase or decrease within the last 6 months. A higher credit limit can help out in an emergency or if you need more funds for a major purchase. You can get a Capital One Platinum credit limit increase either online or by calling customer service at 800 955-7070 to see if youre eligible.

Pay off a high balance. The credit limit increase will only be applied if your account is in good standing. One of the biggest tips I have is for you to put spend on your credit card.

And by spend I. Some Capital One cards especially those advertised toward consumers establishing or. Automatic credit limit increases In many cases Capital One will automatically increase your credit limit if you pay your bill on time consistently.

It must be at least three months old. Capital one Credit Limit Increase As often as youd like but more than once a month is likely overkill.