Learn everything about ProShares K-1 Free Crude Oil Strategy ETF OILK. This ETF offers three times exposure to the daily performance of the Bloomberg WTI Crude Oil Subindex.

Crude Oil Decline Leaves Stock Market Feeling Hungover See It Market

Crude Oil Decline Leaves Stock Market Feeling Hungover See It Market

Free ratings analyses holdings benchmarks quotes and news.

Crude oil etf stock. Crude Oil ETFs track the price changes of crude oil allowing investors to gain exposure to this market without the need for a futures account. Oil exchange traded funds ETFs are ETFs that track the price movements of oil markets usually either crude itself or stocks involved in oil and gas. The universe of oil and gas ETFs that trade in the US.

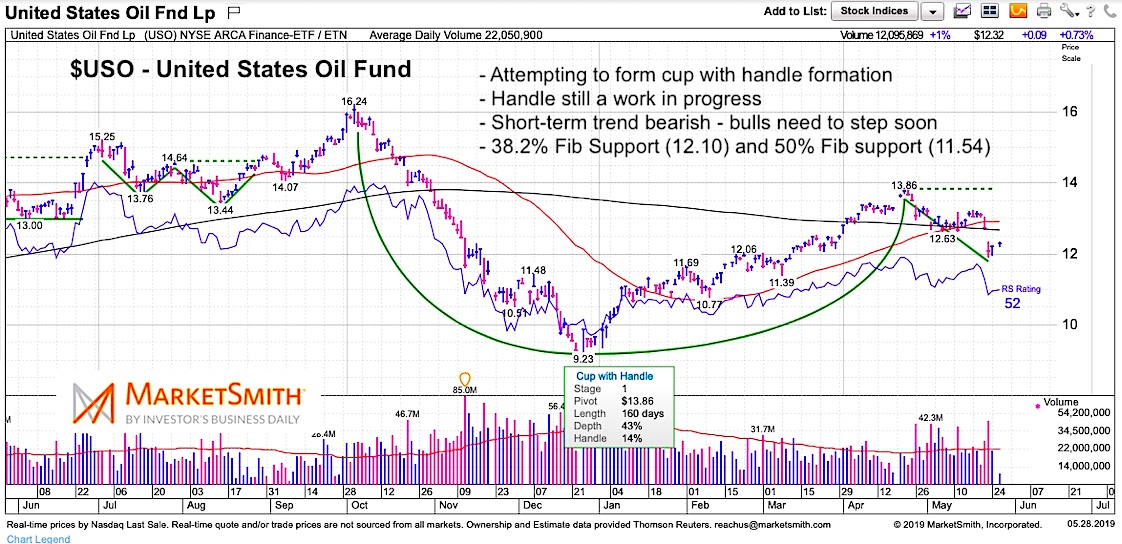

The vast majority are futures. The fund has amassed 789 million in its asset base and trades in solid average volume of 1. United States Oil Fund USO The United States Oil Fund tracks the price of West Texas Intermediate light crude oil through futures contracts.

A0KRJX Realtime-Kurse Stammdaten Kennzahlen und mehr zum ETNS AUF BLOOMBERG WTI CRUDE OIL SUBINDEXWTI CRUDE OIL INDEX von WisdomTree DAX 1511975 -182 Dow 3426800 -136. Oil prices have risen less than the broader stock market over the past year. The United States Oil Fund is an inexpensive ETF that tracks the price of West Texas Intermediate Light Sweet Crude Oil.

Oil stocks pay dividends but an oil ETF is a closer play on crude pricing By Aaron Levitt InvestorPlace Contributor Nov 14 2013 1104 am EDT November 14 2013. Crude Oil And Gas ETFs Rally as Energy Stocks Swell Ian Young February 8 2021 The energy sector is bustling on Monday as the rally in crude oil prices approach a 13-month peak and help catalyze. The funds may be leveraged to magnify returns but are long only.

The fund holds about 16 billion in assets. ICE BRENT CRUDE OIL ETC WKN. This is one of the highest-volume oil ETFs in the US so its very liquid and a good choice for newer oil traders.

In the last trailing year the best-performing Oil. Is comprised of about 12 ETFs excluding inverse and leveraged ETFs as well as funds with less than 50 million in assets under management. These funds track prices on crude oil both Brent and WTI and bet on the underlying commodities by using futures and options contracts.

Aktueller A0KRJX ETF Kurs Charts technische Analysen historische Daten Volumen Marktkapialisierung Fondsvermögen News. Long Crude Oil ETFs seek to track the direct price of various crude oil benchmarks and their pricing. Heres how these two ETPs work.

The ETF seeks to provide its investors with exposure to the performance of the index if they are bullish on oil. WISDOMTREE WTI CRUDE OIL ETC WKN A0KRKU ISIN GB00B15KXV33 Analgepolitik Kurse Werte und Nachrichten Charts und Performance. Inverse Oil ETFs and ETNs Inverse oil andor natural gas ETFs and ETNs are ways to create short positions ie sell a borrowed stock or share in those petroleum commodities by buying a single product thats traded on an exchange.

They offer a way to invest in oil without buying and selling futures. The largest Oil ETF is the SPDR SP Oil Gas Exploration Production ETF XOP with 360B in assets. Its also one of the largest Oil ETFs in the US with over 14 billion in net assets.

ICE BRENT CRUDE OIL ETC. SCO provides 2x daily short exposure to crude oil prices. Inverse oil ETF universe is comprised of a single.

WisdomTree WTI Crude Oil ETF. While crude futures and crude ETFs are falling sharply on Thursday Brent futures added 77 cents or 11 to settle at 6932 a barrel Wednesday while West Texas Intermediate WTI crude climbed. Click on the tabs below to see more information on Crude Oil ETFs including historical performance dividends holdings expense ratios technical indicators analysts reports and more.

Horizons Crude Oil ETF is an energy sector ETF investing indirectly in Solactive Light Sweet Crude Oil Winter MD Rolling Futures Index ER through forward agreements from Canadian financial institutions. The short position is a way of betting on a drop in a market.