SPDR SP 400 Mid Cap Value ETF 4814 XME. Festgeld-Vergleich 2021 Festgeldkonto mit Top-Konditionen finden.

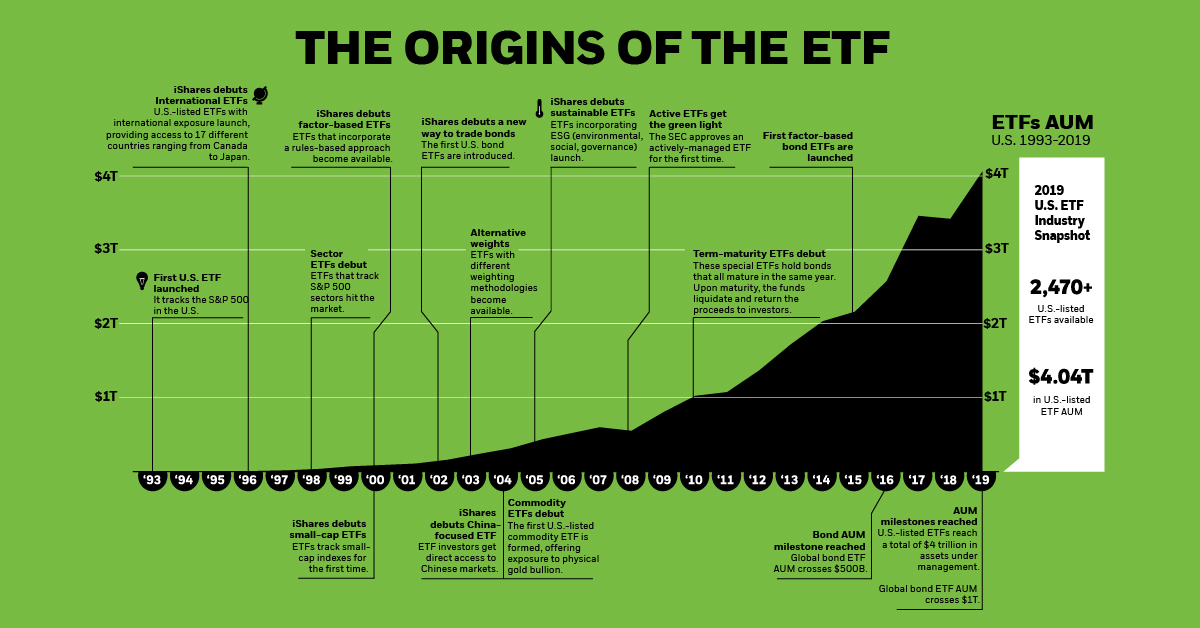

The 26 Year History Of Etfs In One Infographic

The 26 Year History Of Etfs In One Infographic

Der Index bietet Zugang zum europäischen Sektor für Industriegüter und -dienstleistungen wie ihn die Industry.

Industry group etfs. The stocks or ETFS in an Industry Group or ETF Category are then ranked according to the MarketEdge Second Opinion. The metric calculations are based on US-listed Industrials ETFs and every Industrials ETF has one issuer. An industry group is a way of grouping individual companies or stocks based on common business lines.

ETFs allow you to invest in a wide variety of asset classes themes strategies sectors countries and regions. Market sectors are typically. A SIC Code is a standardized method of classifying a companys type of business they appear in a.

Industry sector ETFs invest in the stocks and securities of specific industry sectors such as energy biotechnology or chemicals. Industry ETFs track specific indexes associated with sectors of industry. Most invest in US stocks but increasingly ETF providers are offering products that mimic global industry sector performance.

This means you can make your ETF selection fully in line with your convictions preferences and risk tolerance. Associated fees mean their returns sometimes can underperform their target indexes. They provide a way to invest in an entire industry with one product.

SPDR SP North American Natural Resources ETF 3961 RLY. Unlike mutual funds ETFs trade at market prices like publicly traded stocks. Bleiben Sie am letzten Stand der Daten von Aktien Rohstoffen Währungen Anleihen und andere ETFs in Deutschland.

Heres how it works. SPDR SSgA Multi-Asset Real Return ETF 3344 VLU. 77 Zeilen Industry power rankings are rankings between US-listed industry ETFs on certain investment-related metrics including 3-month fund flows 3-month return AUM average ETF expenses and average dividend yields.

ETF Sparplan-Vergleich 2021 Das beste Depot für Ihren ETF-Sparplan. GICS categorizes stocks into 24 industry groups and 11 sectors. Finally leveraged and short industry sector ETFs are available.

In addition ETF sector groups only contain ETFs whose leverage is single-long and will exclude ETFs who are short double-long or triple-long. Insgesamt entsprechen die Anteile dieser zehn. ETF issuers who have ETFs with exposure to Industrials are ranked on certain investment-related metrics including estimated revenue 3-month fund flows 3-month return AUM average ETF expenses and average dividend yields.

After rallying from the August lows to very overbought levels the ETFs have pulled back and are now trading within their normal trading. The technical condition of the Industry Group or ETF Category is also classified as a market performer outperformer or underperformer based on the status of the MarketEdge Strength rating. Sector power rankings are rankings between US-listed sector ETFs on certain investment-related metrics including 3-month fund flows 3-month return AUM average ETF expenses and average dividend yields.

The following ETF lists provide you with quick access to the different categories. We then distill that mountain of data into clear insightful fund reports on every ETF with the deepest ETF analyst team in the industry. If an ETF changes.

Another method of sectoring stocks is using Standard Industrial Classification SIC Codes. Select the desired category and you will be directed to a list of available ETFs along with the most important key numbers for the ETF. Der ETF investiert direkt in die im Index enthaltenen Wertpapiere.

Tagesgeld-Vergleich 2021 Tagesgeldkonto für Ihre Geldanlage. SPDR SP Metals Mining ETF 4156 NANR. Below we highlight our list of US Industry Group ETFs.

51 Zeilen ETFs auf Short oder Leveraged Indizes sind als kurzfristiges Handelsprodukt. Zu den größten Einzelpositionen im Index zählen die Aveva Group 24 Prozent Nemetschek 23 Prozent Autodesk 22 Prozent Ansys und Baidu jeweils 21 Prozent Yandex 208 Prozent Alphabet 206 Prozent Dassault Systes 2 Prozent Proto Labs 18 Prozent und Altair Engineering 17 Prozent. If an issuer changes its ETFs it will.

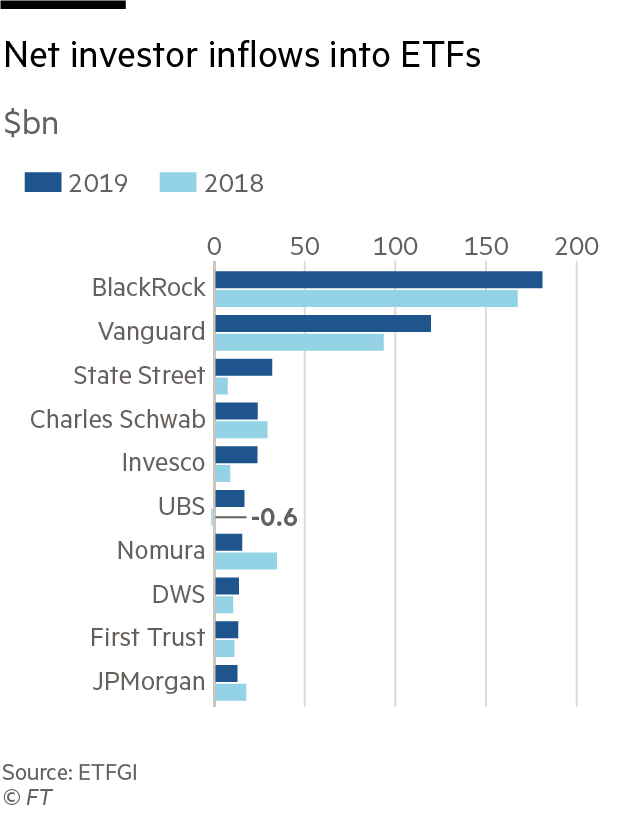

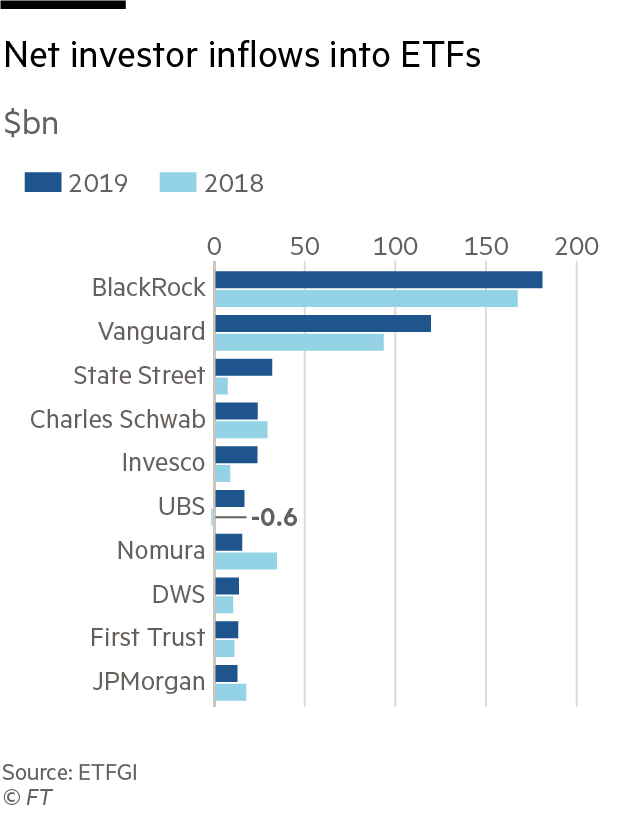

Etf Providers End 2019 On High With Record Assets Financial Times

Etf Providers End 2019 On High With Record Assets Financial Times

Etf Trading Invest In Exchange Traded Funds Ig Au

Etf Trading Invest In Exchange Traded Funds Ig Au

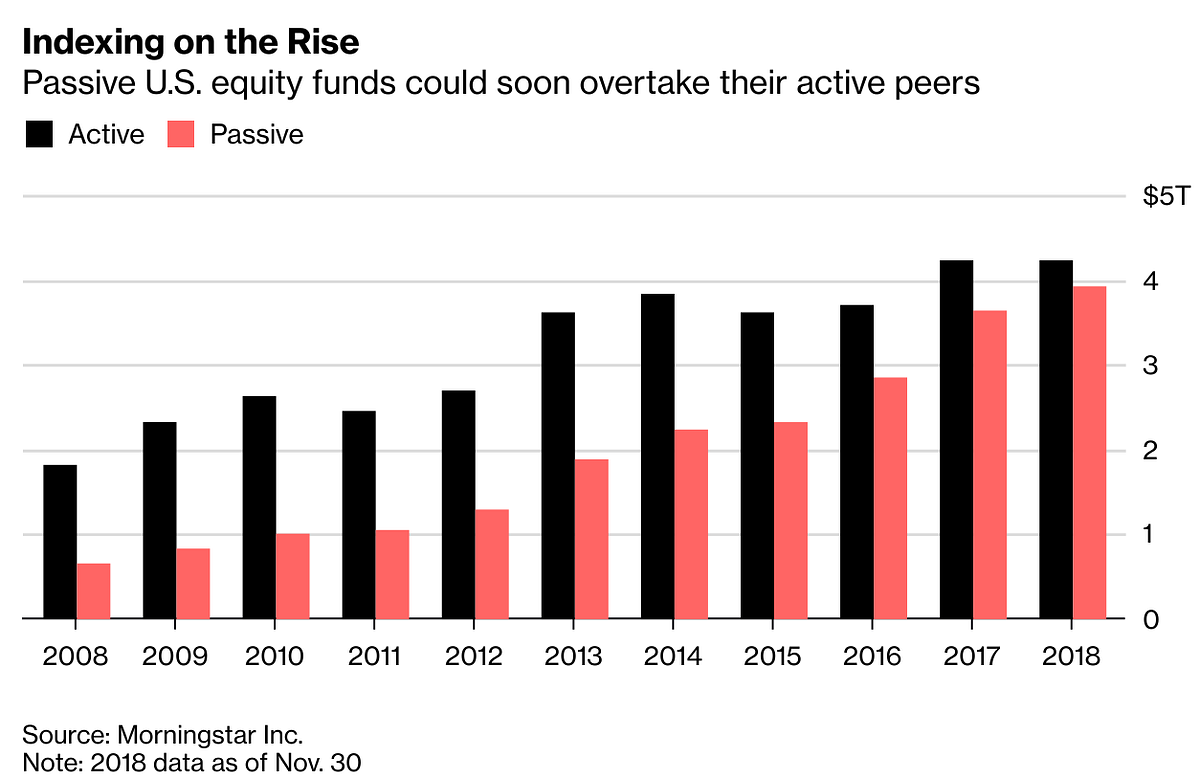

The Etf And Index Industry In 10 Charts The Rise And Rise Of The Passive Industry By Tharsis Souza Phd Datadriveninvestor

The Etf And Index Industry In 10 Charts The Rise And Rise Of The Passive Industry By Tharsis Souza Phd Datadriveninvestor

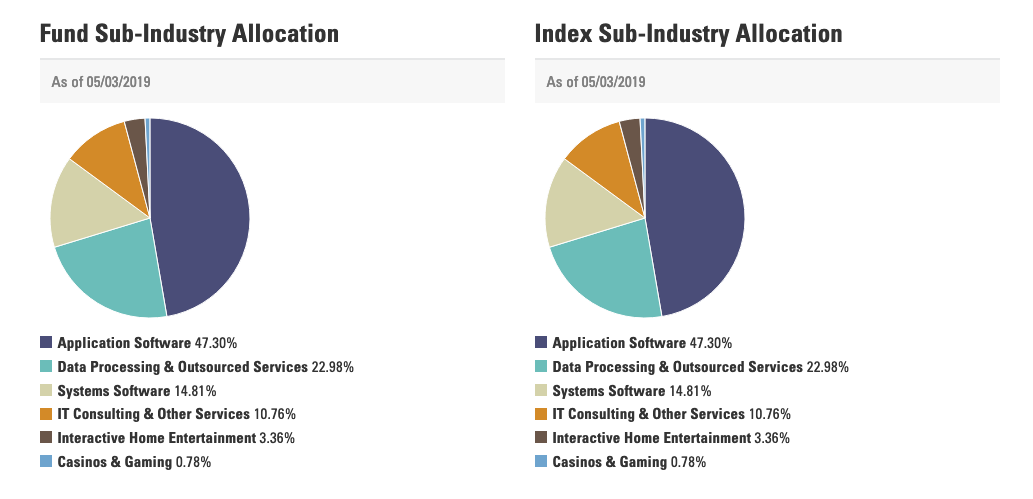

A Tech Etf That Carves Out Its Own Niche In Software

A Tech Etf That Carves Out Its Own Niche In Software

Assets Of Global Etfs 2020 Statista

Assets Of Global Etfs 2020 Statista

Sector Etfs For Specific Industries Vanguard

Industries Etfs Find Stocks Grouped By Industry Allowing You To Search For The Best Stock In The Strongest Industry Or Deteriorating Stocks In Weaker Groups

Industries Etfs Find Stocks Grouped By Industry Allowing You To Search For The Best Stock In The Strongest Industry Or Deteriorating Stocks In Weaker Groups

The Etf And Index Industry In 10 Charts The Rise And Rise Of The Passive Industry By Tharsis Souza Phd Datadriveninvestor

A New Trend Is Shaking Up The Etf Industry Active Management Financial Times

A New Trend Is Shaking Up The Etf Industry Active Management Financial Times

What Sort Of Sector Etfs Are Available Justetf

What Sort Of Sector Etfs Are Available Justetf

What Sort Of Sector Etfs Are Available Justetf

What Sort Of Sector Etfs Are Available Justetf

The Etf And Index Industry In 10 Charts The Rise And Rise Of The Passive Industry By Tharsis Souza Phd Datadriveninvestor

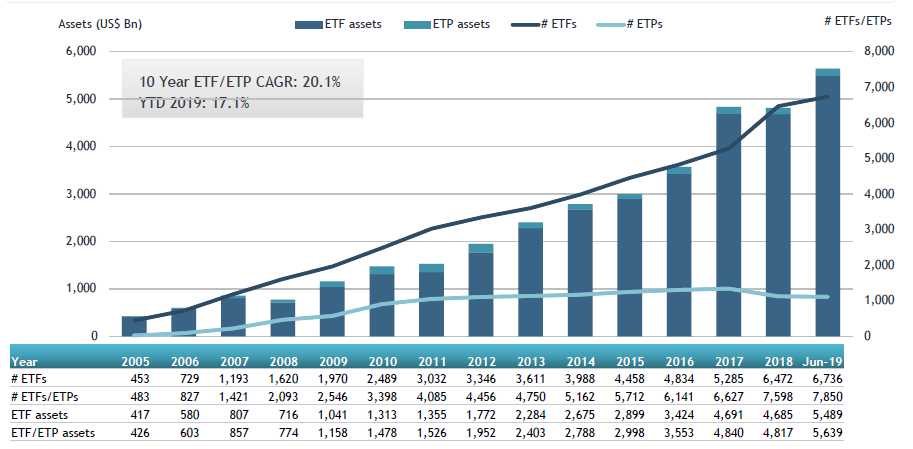

Etfgi Reports Assets Invested In The Global Etf And Etp Industry Reached A Record Us 5 64 Trillion At The End Of June 2019 Etfgi Llp

Etfgi Reports Assets Invested In The Global Etf And Etp Industry Reached A Record Us 5 64 Trillion At The End Of June 2019 Etfgi Llp

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.