Consider opening an account. See our Help page for more information.

![]() Online Savings Products Marcus By Goldman Sachs

Online Savings Products Marcus By Goldman Sachs

Those new funds plus the account balance at the time of enrollment must be maintained for 90 days.

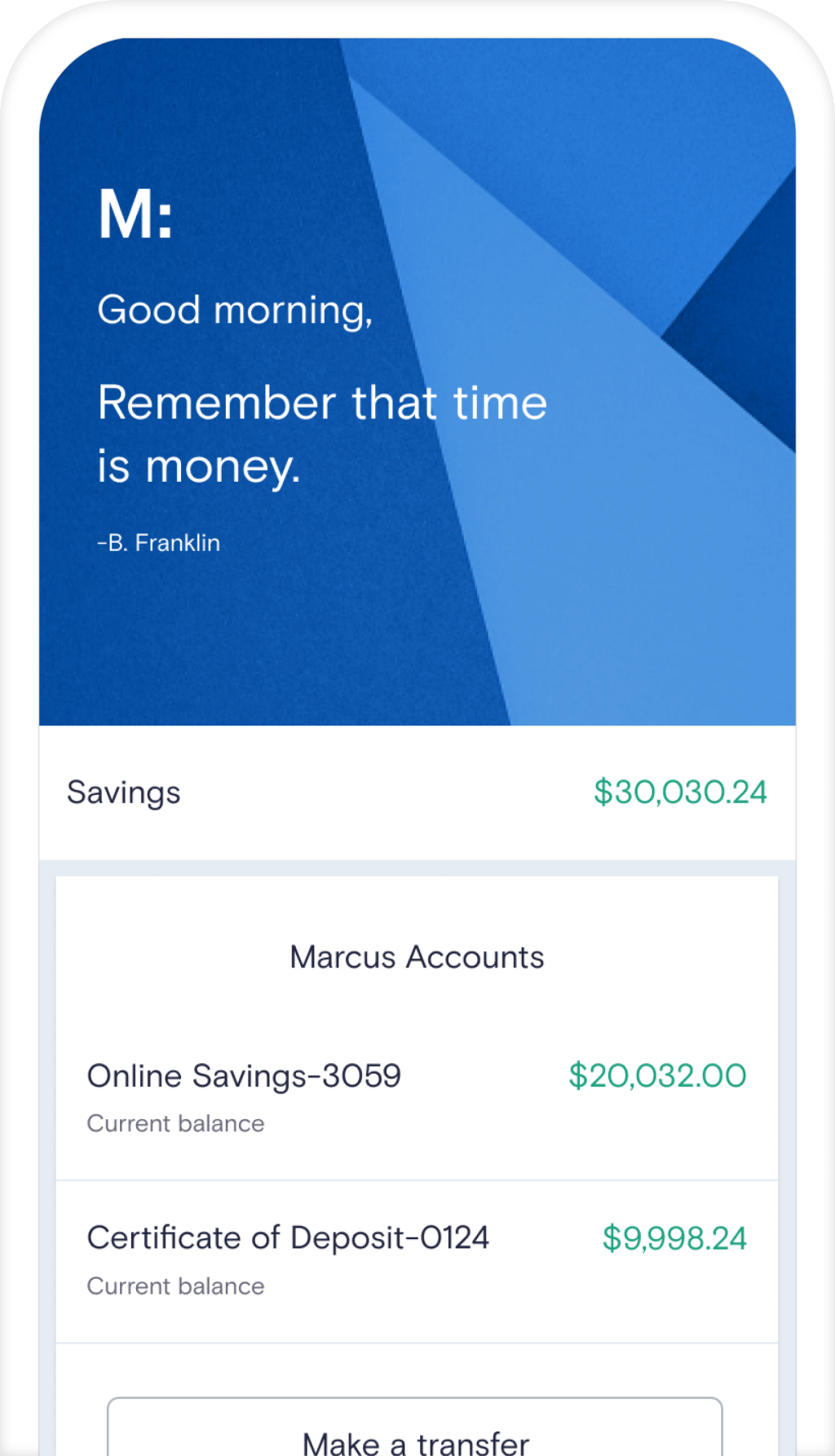

Marcus cd account. Please let us know if you find out any information regarding whether this account triggers a hard or soft pull. Fast easy mobile access to your accounts. Customer service puts you on hold all the time.

Youve entered your full name correctly as it appears on your Marcus account. Marcus by Goldman Sachs CD only offers traditional CD accounts. Once you have deposited these funds you can then begin getting the high yields.

There are no service fees. Marcus offers a high competitive rate on their online savings account. The No Penalty account might be beneficial for someone who has to withdraw money often.

There may be limits to how much you can take out of your Marcus account online in one payment or per day. High Interest With a Required Minimum Deposit. How long a transfer takes When you add money by bank transfer it should arrive in your Marcus account as soon as weve received it.

Marcus CD rates range from 015 on six-month terms to 06 on six-year terms including a 7-month no-penalty CD that earns 045. You only need 500 to open an account which is lower than other banks. The new funds must be deposited within 10 days of enrollment.

Every phone call was 25 to 45 minutes long with most of the time being on hold. I closed a no-penalty CD and it took 9 days and many hours on the phone for 6 days to transfer the CD to a Marcus savings account an internal transfer that should take less than 5 minutes. This is a limited time offer and is quite competitive.

You can open a CD account by depositing a minimum of 500. Marcus by Goldman Sachs offers high-yield CDs which have low minimums and fixed rates. Accounts with longer terms earn at more competitive interest rates.

Marcus by Goldman Sachs CD Account. However you may want to compare them with our best CD Rates. Wed also like your consent to use optional cookies that help us display content thats more relevant to you and.

What to Open at Marcus. We use essential cookies on our website to keep it secure make sure it works properly and comply with obligations that apply to us. Your Marcus account number is correct.

Reach your savings goals with steady growth and guaranteed returns. Only one CD account type available. Opening a CD account with Marcus is free too.

Best 6-Month CD Rates. The 12-month term CD offers one of the best rates on. Marcus by Goldman Sachs also offers a high-yield savings account that has no fees or minimum account requirements.

Marcus CD rates are among the best on the market and it has more term lengths than some of its competitors you can deposit your money for up to six years. When you fund your account with at least 500 within 10 days of opening it youll receive the highest rate Marcus offers for your selected CD. You can earn the following rates when you leave your money in a Marcus CD account for 1 3 and 5-year terms respectively.

Unlike many other banks Marcus gives you 30 days after account opening to fund your CD. Marcus CD rates are solid starting at 055 APY for its one-year CD. There are no maintenance fees on any of the deposit accounts.

Take advantage of a low required minimum opening deposit of just 500. There is no minimum to open and you only need 1 to earn the stated APY. This account offers an annual percentage yield of up to 60 which is much higher than the national average for a CD account.

Get a high yield Certificate of Deposit CD from Marcus by Goldman Sachs today. As the top CD account in the Best Banks 2018 ranking Marcus by Goldman Sachs excels in every field. Deposit 500 and earn a very nice rate.

Get a high yield Certificate of Deposit CD from Marcus by Goldman Sachs today. This is a great opportunity to invest in a high-interest CD from Marcus by Goldman Sachs Bank. If you have a joint account your joint account holder can do the same.

If your Marcus CD account does not reach the 500 minimum deposit within 10 days of the day you open your account your rate will be the interest rate and APY available for your Marcus CD product and term on the day your Marcus CD account reaches the 500 minimum deposit. The sort code is displayed as 40-64-37 and shows Goldman Sachs International Bank. Now through February 12 2021 Marcus by Goldman Sachs Marcus is offering a 100 bonus when depositing 10k or more of new money in a new or existing Online Savings Account.

Marcus by Goldman Sachs is offering a 12-Month Certificate of Deposit with a 085 APY CD Rate. If you have more than one Marcus account and those accounts allow you to move money you can also transfer money between them. Since its a savings account you can make up to six withdrawals per month.

This only applies to Marcus branded CD products. 1-year 25 3-years 260 5-years 280.

Marcus Bank Review High Apys No Monthly Fees

Online Savings Products Marcus By Goldman Sachs

Marcus By Goldman Sachs Cds 2021 Review Should You Open Mybanktracker

Marcus By Goldman Sachs Cds 2021 Review Should You Open Mybanktracker

A Look Inside Marcus By Goldman Sachs This Banking App Has Competitive Rates And Room For Improvement The Business Of Business

A Look Inside Marcus By Goldman Sachs This Banking App Has Competitive Rates And Room For Improvement The Business Of Business

Online Banking Marcus By Goldman Sachs

Online Banking Marcus By Goldman Sachs

Marcus Cd Rates The Ascent By Motley Fool

Marcus Cd Rates The Ascent By Motley Fool

Guide To Cds Marcus By Goldman Sachs

Guide To Cds Marcus By Goldman Sachs

Marcus By Goldman Sachs Cd Rates 12 Month Term 0 85 Apy Cd Nationwide

Marcus By Goldman Sachs Cd Rates 12 Month Term 0 85 Apy Cd Nationwide

Online Certificates Of Deposit Cds Marcus By Goldman Sachs

Online Certificates Of Deposit Cds Marcus By Goldman Sachs

Marcus By Goldman Sachs Bank Review Savings And Cds Nerdwallet

Marcus By Goldman Sachs Bank Review Savings And Cds Nerdwallet

Marcus By Goldman Sachs Savings Account 2021 Review Mybanktracker

Marcus By Goldman Sachs Savings Account 2021 Review Mybanktracker

Marcus By Goldman Sachs Review Get Out Of Debt

Marcus By Goldman Sachs Review Get Out Of Debt

Marcus By Goldman Sachs Cds Review May 2021 Finder Com

Marcus By Goldman Sachs Cds Review May 2021 Finder Com

/MarcusLogo-308835e0ec8f465ea7cb26f218bcd23d.jpg)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.