The top state income tax rate of 454 only applies to single filers earning at least 155159 or joint filers earning 310317 or more. Federal Salary Paycheck Calculator.

Calculate Your Take Home Pay Manage Your Money Natwest

Calculate Your Take Home Pay Manage Your Money Natwest

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

What is my take home pay. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Social Security taxes will take 62 of up to 118500 of your salary and Medicare taxes will take another 145 and is applied to your entire salary no matter how much it is. In fact the mortgage is such a small factor for me that I could easily pay it off before I turn 30.

This federal hourly paycheck calculator is perfect for those who are paid on an hourly basis. How much tax and insurance will I pay. Answer questions such as.

To figure out your after-tax income enter your gross pay and additional details. Please note that our salary calculator is calculating this for FY 2020-21 Current Financial Year. It can also be used to help fill steps 3 and 4 of a W-4 form.

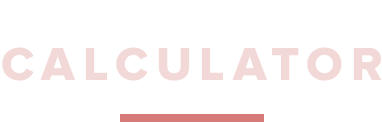

My mortgage MTI is 20 of my take home pay and thats after me contributing 6 to my 401k. In the chart below youll find the after-tax take-home pay for a 100000-a-year salary in the 25 largest US cities which we calculated using SmartAssets paycheck calculator. Youll find calculators and tools online to help you work this out.

To use the tax calculator enter your annual salary or the one you would like in the salary box above. For previous years the values would change. If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month.

Its what has allowed me to be on track to pay off 40k in student loans in one year. Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be calculated as. Find out the benefit of that overtime.

Earners there take home just under 50000 on a 75000 salary largely thanks to steep state income taxes and city taxes. This information may help you analyze your financial needs. Residents in the Valley of the Sun enjoy a graduated state income tax system that helps keep overall tax rates low.

How much will my take-home pay change if I contribute more to my 401k. Updated the tax tables based on the new. What will my take-home pay be.

Take-Home Salary is the total salary that an employee gets after all necessary deductions are made. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free federal paycheck calculator. Estimate your Net Take Home Pay using this Paycheck Calculator for Excel.

That doesnt leave much to cover housing or transportation costs in the. That represents an increase in your take home pay compared to what would happen if you contributed the same amount to a taxable account. A bonus from your employer is always a good thing however you may want to estimate what you will actually take-home after federal withholding taxes social security taxes and other deductions are taken out.

Use this calculator to help determine your net take-home pay from a company bonus. How do the number of allowances affect the federal tax withholdings. When you make a pre-tax contribution to your retirement savings account you add the amount of the contribution to your account but your take home pay is reduced by less than the amount of your contribution.

Updated tax tables for 2021. The reedcouk Tax Calculator calculates how much Income Tax also known as PAYE and National Insurance NI will be taken from your salary per week per month and per year. Your take home pay otherwise known as net pay is the amount you receive each month after any deductions which have to be made like Income Tax and National Insurance.

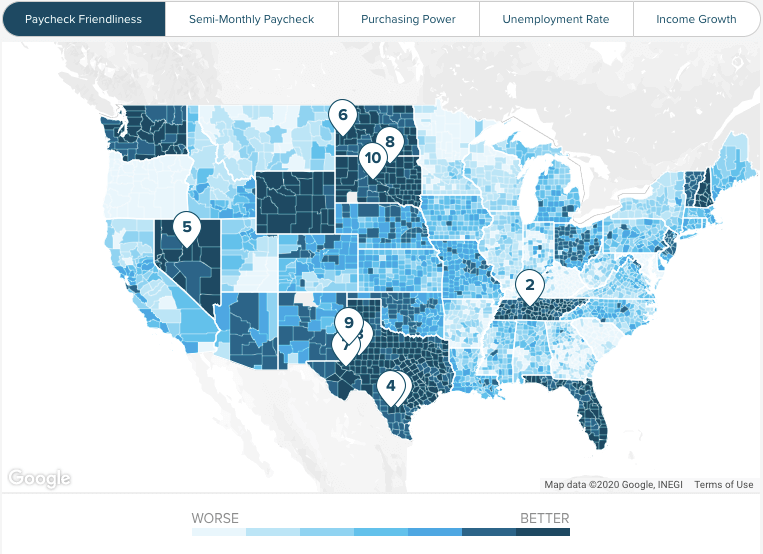

Take-home pay is the net amount of income received after the deduction of taxes benefits and voluntary contributions from a paycheck. How to use the Take-Home Calculator. Understand from below how do we exactly calculate the In-hand or Take home salary.

Enter your salary below to view tax deductions and take home pay and figure out exactly how much money youre left with at the end of the month. 30 8 260 62400. This calculator is intended for use by US.

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

Free Online Paycheck Calculator Calculate Take Home Pay 2021

Free Online Paycheck Calculator Calculate Take Home Pay 2021

The Salary Calculator Take Home Tax Calculator

The Salary Calculator Take Home Tax Calculator

Cost Of Living Calculate Net Dutch Salary

Free Paycheck Calculator Hourly Salary Smartasset

Free Paycheck Calculator Hourly Salary Smartasset

Income Tax Calculator Find Out Your Take Home Pay Mse

Income Tax Calculator Find Out Your Take Home Pay Mse

How To Increase My Monthly Take Home Salary 5 Practical Ways

How To Increase My Monthly Take Home Salary 5 Practical Ways

The Salary Calculator Take Home Tax Calculator

The Salary Calculator Take Home Tax Calculator

How Much Would Be My Take Home Pay With 7 50 000 Inr Per Annum Quora

How Much Would Be My Take Home Pay With 7 50 000 Inr Per Annum Quora

My Take Home Pay Won T Take Me Home

/why-didnt-my-takehome-pay-increase-with-a-raise-5aa00d10c0647100377c1867.jpg) Why Didn T My Take Home Pay Increase With My Raise

Why Didn T My Take Home Pay Increase With My Raise

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Freelancer Contractor Take Home Pay Calculations 2016 17 Jf Financial

Freelancer Contractor Take Home Pay Calculations 2016 17 Jf Financial

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.