In May 2012 New Yorks 529 College Savings Program was renamed New Yorks 529 Advisor-Guided College Savings Plan. Ascensus Broker Dealer Services Inc.

New York S 529 Advisor Guided College Savings Program Ny529 Advisor

New York S 529 Advisor Guided College Savings Program Ny529 Advisor

The Advisor-Guided Plan is sold exclusively through financial advisory firms who have entered into Advisor-Guided Plan selling agreements with JPMorgan Distribution Services Inc.

Jpm ny 529. For more information about New Yorks 529 College Savings Program Direct Plan download a Disclosure Booklet and Tuition Savings Agreement or request one by calling 877-NYSAVES 877-697-2837This document includes investment objectives risks charges expenses and other information. The Advisor-Guided Plan is sold exclusively through financial advisory firms who have entered into Advisor-Guided Plan selling agreements with JPMorgan Distribution Services Inc. New York State single filers can deduct up to 5000 in annual contributions when calculating their New York state income tax.

Formerly Upromise Investments Inc serves as Progam Manager but JP. Easy 529 account management for Financial Professionals. New York taxpayers who open an account in New Yorks 529 Advisor-Guided College Savings Program can enjoy additional tax benefits.

Married couples filing jointly can deduct up to 10000 in contributions. The Advisor-Guided Plan is sold exclusively through financial advisory firms who have entered into Advisor-Guided Plan selling agreements with JPMorgan Distribution Services Inc. Ascensus Broker Dealer Services Inc.

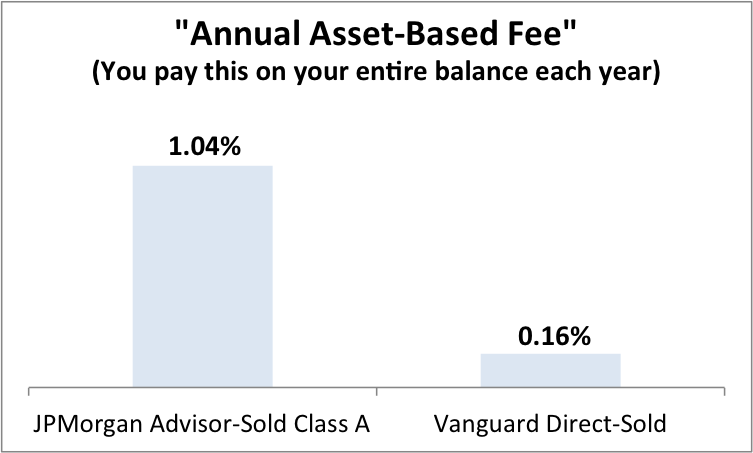

A lot of children and their loved ones saving for college are affected by rates charged by the plan. Safely access and review your clients data. Morgan Investment Management replaced Columbia Management Group LLC as the plans Investment Manager.

Morgan Investment Management replaced Columbia Management Group LLC as the plans Investment Manager. For more information about New Yorks 529 College Savings Program Direct Plan download a Disclosure Booklet and Tuition Savings Agreement or request one by calling 877-NYSAVES 877-697-2837This document includes investment objectives risks charges expenses and other information. Morgan Investment Management replaced Columbia Management Group LLC as the plans Investment Manager.

There are no income limits on a 529 savings plan. Get immediate online access to your clients Ascensus-administered 529 plans with 529 QuickView. Formerly Upromise Investments Inc serves as Progam Manager but JP.

Citizen or resident alien with a valid Social Security number or taxpayer identification number and who is at least 18 years old can open a 529 savings plan. In May 2012 New Yorks 529 College Savings Program was renamed New Yorks 529 Advisor-Guided College Savings Plan. Opens an Account in New Yorks 529 Advisor-Guided College Savings Program the Advisor-Guided Plan or the Plan certain personal information including name street address and date of birth among other informationthat will be used to verify hisher identity.

New Yorks 529 College Savings Program offers some decent tax protections. No more sorting through stacks of paper fumbling through files or waiting for the latest account information to be mailed. In May 2012 New Yorks 529 College Savings Program was renamed New Yorks 529 Advisor-Guided College Savings Plan.

NY 529 Direct Plan offers college savers tax benefits low contribution minimums flexibility and low costs. Investment returns are not guaranteed and you could lose money by investing in the Direct Plan. Whats wrong with it.

New Yorks 529 College Savings Program currently includes two separate 529 plans. New Yorks 529 College Savings Program currently includes two separate 529 plans. New Yorks 529 College Savings Program currently includes two separate 529 plans.

Investment returns are not guaranteed and you could lose money by investing in the Direct Plan. Opens an Account in New Yorks 529 Advisor-Guided College Savings Program the Advisor-Guided Plan or the Plan certain personal information including name street address and date of birth among other informationthat will be used to verify hisher identity. Ascensus Broker Dealer Services Inc.

Formerly Upromise Investments Inc serves as Progam Manager but JP. That means whether your income level goes up or down over the years it doesnt affect your eligibility for your 529 savings plan. Account owners can deduct up to 5000 10000 if married filing jointly in contributions from New York state income taxes each year.

New Yorks 529 College Savings Program currently includes two separate 529 plans. The JPMorgan New York 529 Plan The New York Advisor-Guided 529 Plan has 75 billion in assets. The Advisor-Guided Plan is sold exclusively through financial advisory firms who have entered into Advisor-Guided Plan selling agreements with JPMorgan Distribution Services Inc.

Literature And Forms Ny529 Advisor

Literature And Forms Ny529 Advisor

New York S 529 Advisor Guided College Savings Plan New York 529 College Savings Plan Ratings Tax Benefits Fees And Performance

New York S 529 Advisor Guided College Savings Plan New York 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Income Tax Advantages Ny529 Advisor

Income Tax Advantages Ny529 Advisor

529 Plan Investment Advisors J P Morgan Asset Management

529 Plan Investment Advisors J P Morgan Asset Management

Savings Tips And Strategies Ny529 Advisor

Savings Tips And Strategies Ny529 Advisor

How Not To Save For College A Teachable Moment

How Not To Save For College A Teachable Moment

New York S 529 Advisor Guided College Savings Program Deardorff

New York S 529 Advisor Guided College Savings Program Deardorff

Literature And Forms Ny529 Advisor

Literature And Forms Ny529 Advisor

Literature And Forms Ny529 Advisor

Literature And Forms Ny529 Advisor

New York S 529 Advisor Guided College Savings Program Ny529 Advisor

New York S 529 Advisor Guided College Savings Program Ny529 Advisor

Literature And Forms Ny529 Advisor

Literature And Forms Ny529 Advisor

Https Am Jpmorgan Com Blob Gim 1383284532191 83456 529 F Enroll Pdf

Literature And Forms Ny529 Advisor

Literature And Forms Ny529 Advisor

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.