If youre contemplating applying for an increase in your credit limit double-check your 524 status before applyingjust to be safe. This six month time period may not be a hard and fast rule but its what you can expect to wait.

7 Tips To Increase Your Chase Credit Limit And What To Do If Denied

7 Tips To Increase Your Chase Credit Limit And What To Do If Denied

Know the Credit Cards Credit Limit.

Chase increase credit limit. Chase Increase in Credit Limit Eligibility Requirements There are no strict requirements for a Chase credit limit increase. You should be prepared to make a case for why you deserve the increase. Because the 524 rule.

Ask for credit limit increases on your other cards. One way to obtain an increase is to request a new Chase card with a higher limit than your existing card. The representative will likely ask you why you need more credit so have all the information you gathered beforehand ready to go.

The most straightforward way to get a credit limit increase is by calling Chase directly and asking a representative about a CLI. A credit limit increase is a sign of healthy credit. Chase extending the 524 rule to include credit limit increases is another example of card issuers and lenders showing concerns due to the ongoing pandemic.

Chase cardholders in good standing may occasionally receive an automatic credit limit increase. These 3 tips will make sure your credit limit is boosted. Do you want to increase your credit with Chase but are unsure of where to start.

How Do I Request a Credit Limit Increase with Chase. Chase generally isnt a lender to limit build with. Unfortunately the Chase Freedom Flex reviews seem to be split on the best way to obtain a credit limit increase.

Some people also open up a new Chase card and then ask to move the credit limit over to the card they want the higher limit on. You arent going to get an increase higher than a given credit cards total credit. This is helpful overall because when your credit limit increases on other cards your credit utilization ratio goes down.

The final and most common way to get a credit limit increase with Chase is to call the number on the back of your card and request one. Its still unclear whether Chase is implementing this rule across the board. When you log into your Chase account youll see the current balance and available.

When the limit on your other cards increases you credit utilization ratio goes down. You get the gnarly limits from them after you have from somewhere else typically 1 As someone who has been a Chase cardholder for 19 years and currently holds six of their cards this is good info. Your outstanding HELOC balance will be refinanced into a new HELOC which will transfer your current HELOC balance into a new line of creditwith new terms and conditions including interest rate and revised draw and repayment periods.

You are more likely to. To increase your odds of earning an automatic limit increase from Chase make sure you manage your. Like many banks Chase will often require you to wait about six months before they will consider increasing your credit limit.

You may even be able to reallocate a portion of the new credit amount to the card you originally wanted increased as well. Rather than opening a new card try requesting for a limit increase on your other cards. Request a credit limit increase on other cards.

How to Avoid the 524 Rule. How to increase a HELOC limit. Know Your Current Credit Limit.

The first is through an automatic increase which is an unsolicited credit limit increase granted by the issuer. They will usually direct you to someone in a different department and you can make your case and tell them why youd like the credit limit increase. This can help boost your credit score making it easier for you to increase the credit limit on your Chase account.

When a limit is raised ratios like your utilization drop boosting your credit score. The basics of increasing your home equity line of credit. Here are some of the best Chase high-limit cards currently available.

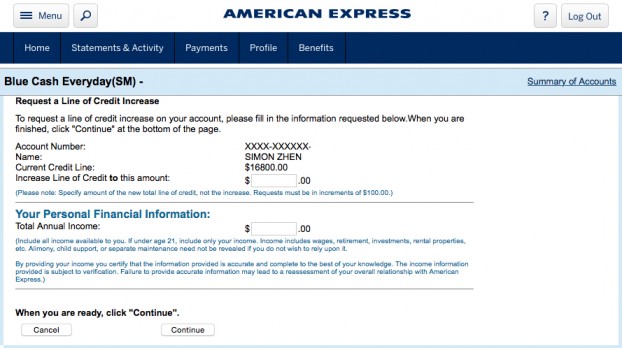

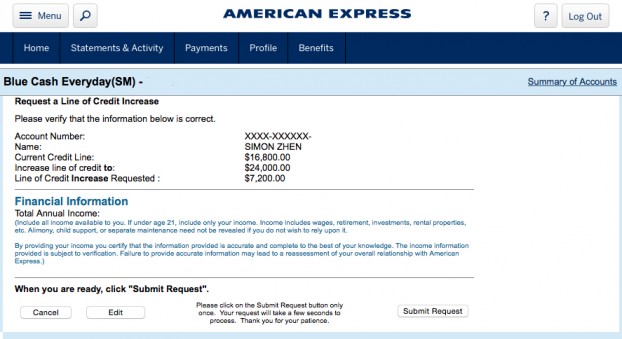

Whether the credit increase addition is a hard rule going forward or if it is a temporary situation during COVID-19 remains to be seen. With that in mind it stands to reason that Chase would be stricter with credit limit increases. The second is to request a credit limit increase through the issuers website or customer service line.

However there are some common-sense rules of thumb to improve your eligibility.

Chase Com Increasemyline Increase Chase Credit Limit 2021

Chase Com Increasemyline Increase Chase Credit Limit 2021

How To Request A Credit Line Increase With Chase Creditcards Com

How To Request A Credit Line Increase With Chase Creditcards Com

How Can I Increase My Credit Card Limit By 22 Percent

How Can I Increase My Credit Card Limit By 22 Percent

Chase Credit Limit Increase Actionable Tips To Scoring One In 2021

Chase Credit Limit Increase Actionable Tips To Scoring One In 2021

Chase Credit Line Increases Cli Consolidated Page 4 Flyertalk Forums

Chase Credit Line Increases Cli Consolidated Page 4 Flyertalk Forums

How To Increase Credit Limit It S Easier Than You Think

How To Increase Credit Limit It S Easier Than You Think

How To Increase Credit Limit It S Easier Than You Think

How To Increase Credit Limit It S Easier Than You Think

6 Expert Tips How To Increase Credit Limit Chase Cardrates Com

6 Expert Tips How To Increase Credit Limit Chase Cardrates Com

How Can I Increase My Credit Card Limit By 22 Percent

How Can I Increase My Credit Card Limit By 22 Percent

Which Credit Card Companies Do A Hard Pull For A Credit Limit Increase Doctor Of Credit

Which Credit Card Companies Do A Hard Pull For A Credit Limit Increase Doctor Of Credit

Requesting An Increased Cash Advance Limit From Chase For Online Serve Reloads

6 Expert Tips How To Increase Credit Limit Chase Cardrates Com

6 Expert Tips How To Increase Credit Limit Chase Cardrates Com

How To Increase Credit Limit It S Easier Than You Think

How To Increase Credit Limit It S Easier Than You Think

How To Increase Credit Limit It S Easier Than You Think

How To Increase Credit Limit It S Easier Than You Think

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.